CARES Act Updates and Your Retirement

Historically, 70½ is the age when individuals have been required to take required minimum distributions (RMDs) from their retirement accounts, having until April 1 of the following year to take the first distribution.

The SECURE Act of 2018 changed that rule, raising the age for RMDs from 70½ to 72 while the CARES Act 2020 has made further significant changes. Below are important updates you need to know.

A retirement–related provision of the CARES Act 2020 allows the owners of certain retirement accounts — including inherited and beneficiary accounts — to skip otherwise mandatory RMDs for 2020. This provision applies only to defined contribution plans, including, 401(k) and 403(b) plans, IRAs, SIMPLE IRAs and SEP IRAs.

For those who want to take their RMDs, Cares Act Notice 2020-51 includes a sample plan amendment that provides participants and beneficiaries the option to receive their RMDs.

If you’ve already taken a now-waived RMD for 2020, you may be able to redeposit the funds. However there is a timing factor involved. Generally, such funds must be redeposited within 60 days of the distribution. Under the CARES Act 2020, the deadline for redepositing RMDs distributed in 2020 has been deferred to August 31.

With respect to repayments, Cares Act Notice 2020-51 eliminates the once-per-year IRA rollover rule, which requires (and allows) only one rollover from an IRA in any 365 day period. It also removes this restriction for inherited IRAs.

The CARES Act 2020 further extends the rollover option to the IRA owner, a beneficiary spouse, and/or a non-spouse beneficiary, as long as the plan participant died in 2019 and the rollover occurs before the end of 2021.

Before the CARES Act 2020, money could not be withdrawn from a retirement account before the age of 59 ½ without incurring a 10% percent early-withdrawal penalty. Under the Act, individuals may be able to take one or more hardship withdrawals from their retirement accounts without penalty if they fall in to any of the following categories:

- You, your spouse or your dependents are ill, having been diagnosed with COVID-19.

- You’ve been hurt financially because you are out of work (quarantined, laid off, furloughed)or your hours are reduced.

- You cannot work or get child care due to COVID-19.

- You fall under another COVID-19 category established by the US Treasury Secretary

It’s important to note that such hardship withdrawals are limited to a total of $100,000 without incurring a penalty, unless you are at least 59 ½ years of age. Also, employers can place limitations on withdrawals from their 401(k) and 403(b) plans and those withdrawals are included in your taxable income over a three year period. You can avoid paying the income tax if you repay the withdrawals within the three years.

The same COVID-19 eligibility categories that govern hardshipwithdrawals also govern retirement account borrowing from current 401(k) and 403(b) plans. (Note: IRAs do not allow for this type of borrowing.)

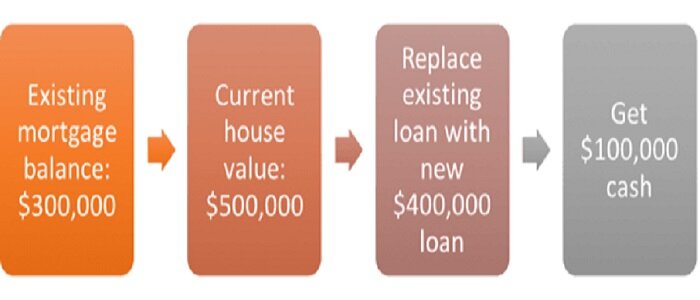

Pre-Act, the maximum loan amount you could borrow was $50,000, or 50 percent of the vested balance in your account, if lower. Under the CARES Act 2020, you can borrow more. The maximum loan amount is the lesser of $100,000 or the vested balance in your account. Any loan repayments due between March 27, 2020 and December 31, 2020 are delayed for one year. However this one year delay is not factored in when accruing interest charges on the loan, which are based on the rules of your plan.