Retirement: To Do It or Not? And When?

Retirement. A time in life to which we all look forward. However, According to the Bureau of Labor Statistics, in 2016, 26.8% of those between the ages of 65-75 continued to work—a number that is expected to rise to 30.6% by 2026.

There are varying reasons Americans are postponing retirement, from economic stability to personal fulfillment. Whatever the reason, and however long you might plan to remain working, there are retirement-related financial concerns that should be addressed in your sixties to ease your eventual retirement transition and avoid potential snags down the road.

Wait to File for Social Security

Just because you reach “full retirement age”(FRA)doesn’t mean you have to collect Social Security benefits, especially if you’re still working. The longer you wait, the more your benefits will increase—up to age 70.

Monthly benefits increase between six and seven percent for every year you delay from age 62 to your FRA, and then grow eight percent a year between your FRA and age 70. If you are healthy and longevity runs in your family, you stand a good chance of increasing your lifetime benefit by postponing your start date.

Enroll in Medicare Part A

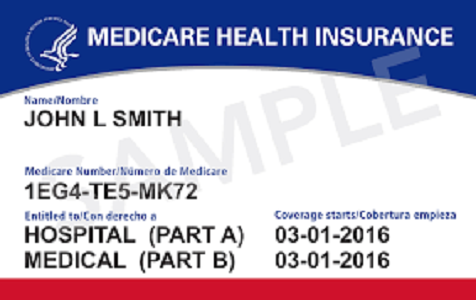

If you’ve already filed for Social Security, you’ll be automatically enrolled in Medicare Part A and Part B at age 65. But if you haven’t, you have a choice to make.

Most people will benefit by enrolling in Medicare Part A at age 65 whether or not they continue to work. There are no premiums, and enrolling now will help you avoid potential penalties or delays down the road.

If you’re covered by your employer’s plan and your company has 20 or more employees, that plan will remain your primary coverage. If you work for a company with fewer than 20 employees, Medicare will be your primary insurer.

*Another caveat: Once you enroll in any portion of Medicare, you can no longer c*ontribute to a Health Savings Account. So if you’re relying on your HSA to boost your savings, you’ll need to postpone Medicare.

Consider Postponing Medicare Parts B and D

If you work for a company with fewer than 20 employees, you’re probably best off enrolling in Medicare Part B and Part D when you turn 65. But if you work for a larger company, you may well be better off sticking with your employer plan and enrolling in Medicare once you retire. This link to a Medicare.gov website provides information on costs and coverage that may help you make a decision.

Once you leave your job, you will generally have eight months to enroll in Part B or face a penalty. Part D also has a late enrollment penalty if you go more than 63 days without “creditable” prescription drug coverage. Creditable means that your existing insurance is expected to pay as much as the standard Medicare prescription drug coverage.

Continue to Save for Retirement

No one should ever walk away from an employer’s 401(k) match, but it makes sense to try and save more. The good news is that as long as you are working, you can continue to contribute the legal maximum ($26,000 in 2020) to your 401(k) regardless of age. If you anticipate being in a high tax bracket come retirement, you might want to consider a Roth 401(k), if available.

You can also contribute up to $7,000 to either a traditional or Roth IRA as long as you have earned income, although in 2020 Roth IRAs are restricted to those who earn less than $206,000 (combined income for a married couple filing a joint return) or $139,000 (single).

Note that the 2019 SECURE Act extended the age limit for contributing to a traditional IRA from age 70½ to 72.

Don’t Forget About Required Minimum Distributions

The CARES Act passed in March of 2020 has temporarily suspended all required minimum distributions (RMDs) for 2020, regardless of age. This includes 401(k)s and traditional IRAs.

Starting in 2021 when the CARES Act expires, we will revert back to the RMD rules established by the 2019 SECURE Act. If you did not turn 70 ½ by 2020, you can wait until the year in which you turn 72 to start taking your required distributions.

Also note that earning a paycheck means you can delay taking a required minimum distribution (RMD) from your 401(k). As long as you are working (and you don’t own more than 5% of the company), that requirement is waived until April 1 of the year you retire. There are also no RMDs for Roth IRAs at any age.

Think About Your Mortgage

Conventional wisdom says we should pay off our mortgages before we retire, but it’s important to look at your mortgage in the context of your complete financial profile. Before you rush to pay off your mortgage, especially if that involves selling securities or will reduce your liquidity, you should consult with your financial advisor.

Plan How to Turn Your Portfolio into Your Paycheck

Switching from saving to spending and depleting what you’ve worked so hard to build can be a difficult transition. Before you stop working:

- Review your net worth statement to understand exactly where your stand.

- Make a retirement budget and stash away a minimum of a year’s worth of cash.

- Review your portfolio to make sure you have the appropriate balance of risk and safety.

- Consult with your financial advisor to create a tax-efficient drawdown strategy.

It’s great to choose to work for as long as it’s financially and personally rewarding, but planning carefully for the eventual transition to retirement can make the next phase of life even more fulfilling.

This blog was excerpted from an online article by Carrie Schwab-Pomerantz, CFP®, Board Chair and President, Charles Schwab Foundation; Senior Vice President, Schwab Community Services, Charles Schwab & Co., Inc.; Board Chair, Schwab Charitable