Make Sure You’re Ready

According to a recent survey, 80% of Americans say that saving for retirement is critically important. However, only 56% are actually putting money away for their golden years.

In 2006 U.S. Senators Gordon Smith and Kent Conrad introduced a resolution that was passed by Congress, creating National Retirement Security Week in the third week of October (this year October 18-24.) On September 2, 2020, the National Association of Government Defined Contribution Administrators (NAGDCA) updated its legislative priority to advocate for October to become National Retirement Security Month.

The purpose of observing National Retirement Security Week/Month is to raise awareness and help individuals take concrete steps towards a secure retirement. Over and above elevating public knowledge on the subject, there is also an effort to encourage employees to speak to a retirement plan consultant or expert and participate in an employer-sponsored retirement plan if available.

At Note Advisors, we are here to help you build and increase your retirement funds. While it can seem like an overwhelming process, here are some basic ways that you can start to secure your retirement future.

Start saving money

Statistics show that 32% of Americans did not start saving for their retirement until they were in their 30s. Another 13% waited until their 40s. The longer you wait, the greater the amount you will need to save each month, but it’s never too late. Start saving now.

Automate Your Savings

Have your contributions automatically deducted from your paycheck to guarantee that you are saving.

Boost Contributions as You Age

If you are over 50 years old, you can save an extra $6,000 per year tax deferred.

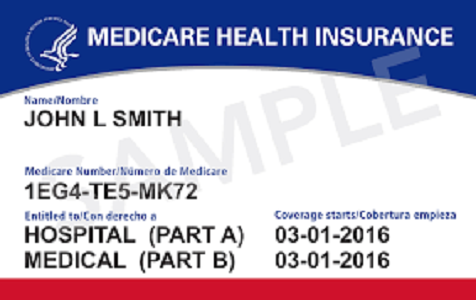

Don’t Rely on Social Security

Social Security was never meant to serve as a total retirement income replacement source It was meant to supplement pension income. Further, nearly a quarter of public sector employees are ineligible. Social Security benefits replace roughly 40% of pre-retirement income among average earners. While this is a meaningful supplement to other income sources, it’s hardly enough to maintain a comfortable lifestyle on its own.”

If You’re Young, Invest More Aggressively

Choosing a more aggressive investment strategy early will quickly grow your nest egg and also give you time to recoup if the market takes a dip.

Meet Your Company Match

If your company offers to match your contribution up to a certain percentage do it. It’s free money and that match can be tax-deductible for your employer as well. Diversify Add a tax-advantaged retirement account like a Roth IRA to your retirement portfolio, so that some of your saving grows tax free.

No Company Retirement Plan?

While 28% of Americans take full advantage of their company’s retirement saving options, 20% aren’t offered a plan by their employer, or are independent contractors. If you fall into that category, consider alternative solutions, like an Individual Retirement Account (IRA).

Speak with a retirement plan consultant or expert

Nearly 60% of Americans say they have a workable knowledge of how retirement plans operate, but 30% say they don’t have a clear vision of their own plan. If you are unsure about planning your retirement, we at GCW Capital are here to help. Contact us today and let’s work together to develop a retirement strategy that meets your needs and will fund your future.