Women and Investing: Life Lessons to Learn

There are many statistics about the gender pay gap worldwide. For example, in the United States, women still only earn 82 cents to a man’s dollar. It is also well acknowledged that women, on average, outlive men. So, the importance of women saving and investing to help make up for this deficit is obvious.

The thing is, according to a study conducted in the late 90s by Brad M. Barber and Terrance Odean, while women have many traits that would make them good investors, they are far less confident than men in their investing ability. In fact, data from several studies over the years show that even when women have investment accounts, they hold the majority of their money in more conservative holdings like bonds and cash.

The question becomes, how to get women not only to invest, but to invest more aggressively when appropriate. The following five tips can help.

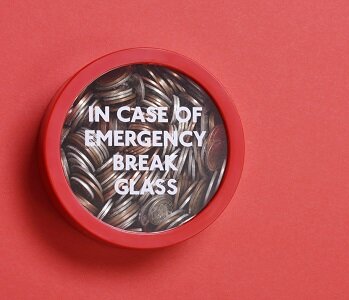

1. Begin With an Emergency Fund

The first step to financial security is having enough cash in a savings account to cover at least three-to-six months’ worth of unexpected expenses. This fund will not only help you in case of an emergency, but can also give you the confidence to start investing and help weather a market downturn.

2. Look to retirement

Whether you’re in your 20s or your 40s, you can’t afford to wait to start saving for retirement. And even though women are known to put others’ needs first, when it comes to retirement, you have to think of yourself. Take full advantage of a company retirement plan like a 401(k). In fact, this is a great way to begin investing. Contribute at least up to the company match, more if possible. Don’t have a company plan? Consider an IRA. The point is to save as much as you can as soon as you can. Living to 90-plus is becoming more common. You need to be prepared.

3. Invest in stocks

Your first thought may be that you don’t want to take the risk. Market downturns definitely happen as we’ve recently seen, but being too cautious can also put you at a disadvantage. Stocks are an important part of any portfolio because of their long term potential for growth and higher potential returns versus other investments like cash or bonds.

As evidence, consider this statistic: a dollar kept in cash investments from from 1926 to 2019, would only be worth $22 today. That same dollar invested in small-cap stocks over those 93 year would be worth $25,688 today.1

So where to begin? Many broad-based mutual funds and exchange-traded funds make it easy to invest in a cross-section of stocks. An index fund or target-date fund can make it even easier. Using a robo advisor can also be a good way to begin. You don’t have to know a lot to start; you just need to know where to start.

4. Plan for Other Financial Goals

What are your other goals—a down payment on a home, a child’s education or a vacation? Investing a portion of your savings in stocks may help you reach those goals faster, with the caveat that money you think you’ll need in three to five years should be in less risky investments. Stock investing should ideally be long-term, understanding how much risk you can stomach, and how much risk you can afford to take.

5. Ask for Help and Advice

When you have questions, ask your benefits administrator, your broker, even a knowledgeable friend or family member—but ask. There are also lots of online investing resources to explore. Need more? Consider working with a financial advisor.

A financial advisor is sort of like a personal trainer, someone to guide you and keep you going when you might otherwise be tempted to call it quits. He or she should understand your feelings, situation, and goals. Never hesitate to ask questions, including how your advisor is paid.

No time like the present

Time is a crucial factor in investing. If you have many years ahead of you to invest—and you commit to keeping your money invested—time will likely help you weather the inevitable market ups and downs. That’s not to say you can’t start investing later in life, but keep in mind that money you’ll need in the short-term should not be in the stock market.

That said, women need to develop the knowledge base and confidence to make the most of their hard-earned savings and build financial independence through investing. It doesn’t take a lot of money; it just takes getting started. Contact Angela Hall, CFP, if you’re ready!

[1] Source: Schwab Center for Financial Research. The data points above illustrate the growth in value of $1.00 invested in various financial instruments on 12/31/1925 through 12/31/2019. Results assume reinvestment of dividends and capital gains; and no taxes or transaction costs. Source for return information: Morningstar, Inc. Based on the copyrighted works of Ibbotson and Sinquefield. All rights reserved. Used with permission. The indices representing each asset class are CRSP 6-8 Index (small-cap stocks) through 1978, Russell 2000 thereafter; and Ibbotson U.S. 30-day Treasury bills (cash investments). Past performance is no guarantee of future results.

Parts of this blog were excerpted from an online article by Carrie Schwab-Pomerantz,CFP®, Board Chair and President, Charles Schwab Foundation; Senior Vice President, Schwab Community Services, Charles Schwab & Co., Inc.; Board Chair, Schwab Charitable